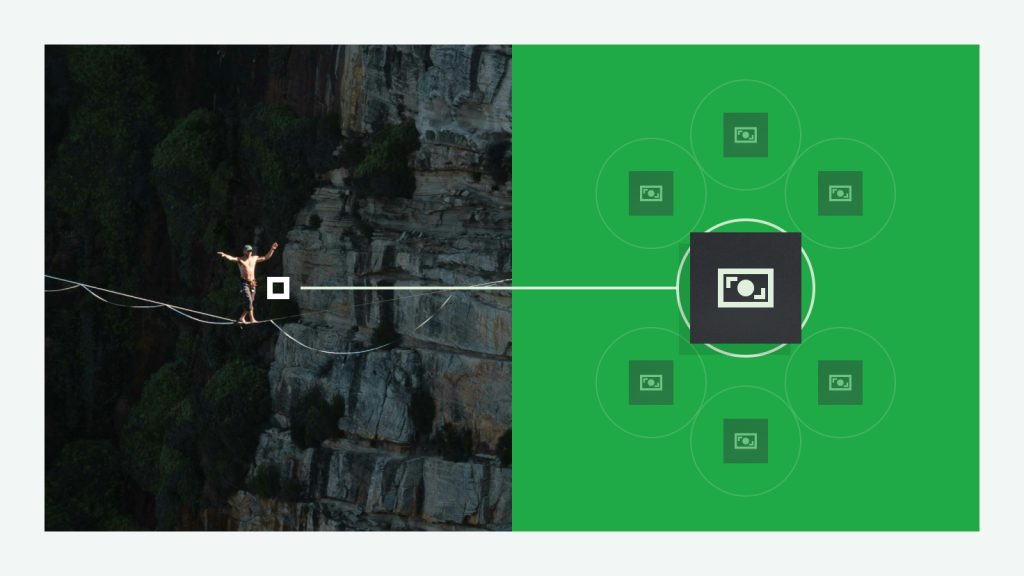

As the investment landscape evolves, new trends, asset classes, and a changing macroeconomic environment alter traditional investing norms. So when it comes to achieving investment goals, the balance between risk

Search Results for: esto

January 2025 has so far brought significant shifts in global trade, technology, and economic policy, each with far-reaching implications for investors. The U.S. is moving toward a more protectionist economic

Mintos is excited to announce a major expansion of its bond offering. This development provides investors with access to a broad selection of corporate and government bonds, offering valuable opportunities

Choosing the right platform for your investments can make a significant impact on your financial growth. Mintos and Bondora are two well-known platforms that provide investors with unique ways to

Learn what a prospectus is, the differences between a prospectus and an annual report, prospectuses on Mintos, and how to effectively read a prospectus to make informed decisions. Ideal for

When building a diversified portfolio, investors seek low-risk investments that provide both liquidity and stability. Money market funds are designed to fulfill this role by offering a safe place to