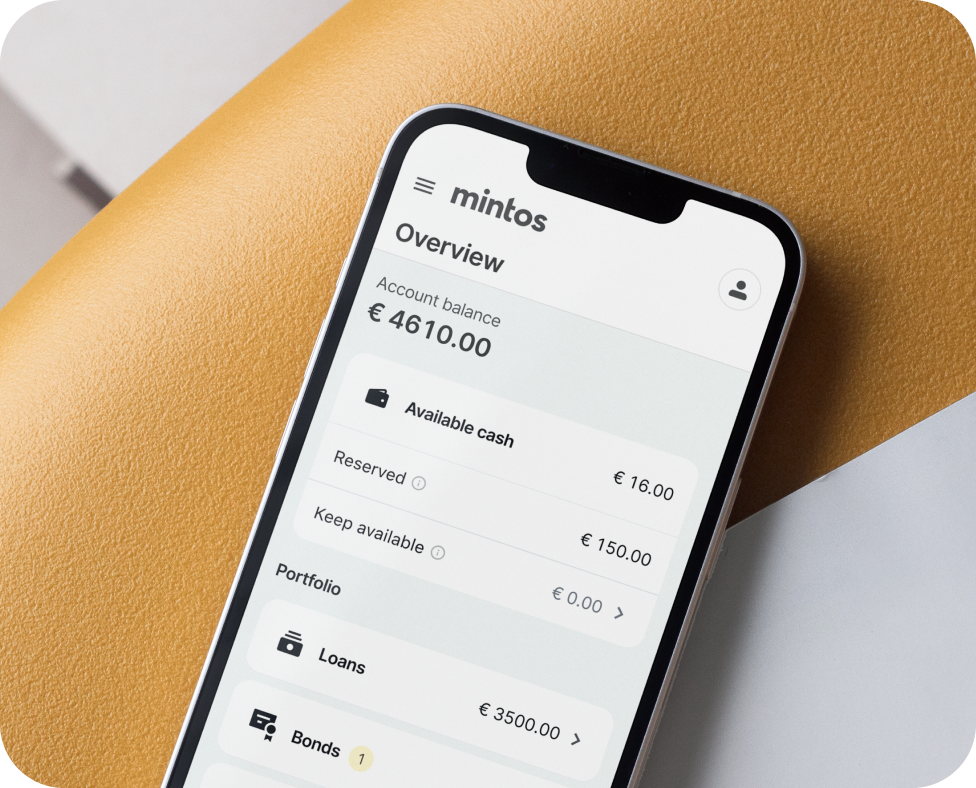

Turn your money into regular income

Earn regular returns, diversify your portfolio, and build your wealth with traditional and alternative investments. Start passive income investing on Europe’s leading platform today.

Invest your way

Mintos was made to work for you – whether you’re an experienced investor, or just started.

Save time with our ready-to-go, fully automated portfolios. Or take full control of your investments. The choice is yours.

Unique asset mix

Diversify your investments across many asset classes to manage your risk and earn more stable returns.Earn regular, passive income

Earning regular income from your investments can be a great way to grow your wealth.

Tired of restrictive investment strategies that rely on long commitments or high risk? Invest in assets that generate a regular income stream, and you can see your money grow from day one.

Invest with confidence

Investing in a regulated environment offers transparency and investor protection.

Your cash and securities are held separately from Mintos’ assets, and are protected up to €20 000 under the investor compensation scheme.

Mintos is a member of the national investor compensation scheme established under Directive 97/9/EC. The scheme provides compensation if Mintos fails to return financial instruments or cash to investors. The compensation is limited to the outstanding liabilities, up to €20 000. The scheme doesn’t compensate for losses due to changes in the price or liquidity of financial instruments.

Investor protectionNew to investing?

No worries, we’re here to help.

We'll get you up to speed with the basics of investing. And we’re happy to answer any questions about Mintos you might have.