Key takeaways

- Prospectus document is based on the Prospectus Regulation

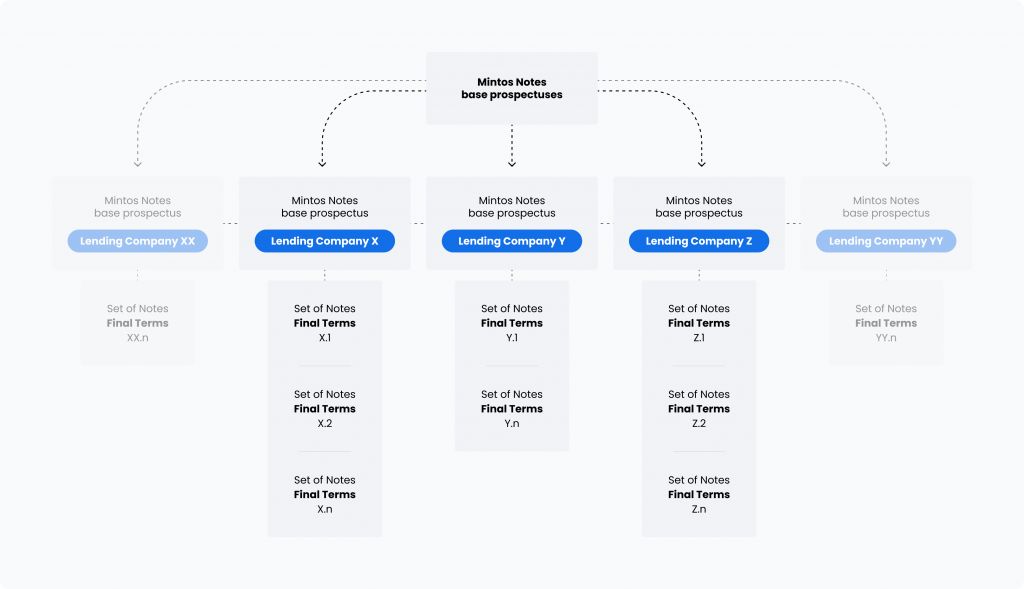

- The Mintos Notes base prospectuses will define Mintos-based structures such as association to lending companies, payment flows, and risks

- Each lending company will have a dedicated base prospectus

- Details not defined in the Mintos Notes base prospectus will be defined in the “Final Terms”

- The annexed document “Final Terms” will serve as an “identification card” for each Set of Notes

- Lending companies on Mintos will gradually transition to the new setup

Becoming a regulated investment firm means following a precisely defined set of rules established through the financial regulation of a specific market. These rules protect users of financial services and preserve the stability of the financial system as a whole.

Now that Mintos is a regulated investment firm, we recently wrote about investor protection in a regulated environment where we mention the most prominent regulations included in Mintos’ regulatory framework – one of them being the Prospectus Regulation.

In this article, we share more about what a prospectus is and explain the Mintos Notes base prospectuses – documents that aligns with the requirements of the Prospectus Regulation for the Mintos financial instrument – Notes.

What is a prospectus?

Any funding or investment offer includes a “pitch document” where the offering or seeking party provides information about itself, for example, the reasoning behind the funding offering/needs, the calculated amounts needed, the repayment terms, and proceeds for investors involved. When funding is in the form of a publicly offered security, the key legal document enclosed is the prospectus.

The Prospectus Regulation defines the format, content, and system of approval for prospectus documents. It also sets up a unified framework that’s user-friendly and applies to different types of investments.

Once a written prospectus is filed with the respective regulator and approved, it’s shared with investors so they can review it before making any investment decisions. The detailed information provided in a prospectus serves as a risk-assessment tool for investors, which aims to aid decision-making by giving more insight into an investment opportunity.

About the Mintos Notes base prospectuses

In the process of becoming a licensed investment firm, we had to design a prospectus template for the newly developed Mintos financial instrument Notes, which are loan-backed securities. Led by our Legal team, an in-house team of more than 30 people worked to build the 90-page Mintos pilot case prospectus from scratch. Pilot case prospectus is a base used to prepare prospectuses for lending companies that have issued underlying loans for Notes investments – every company will have a dedicated base prospectus. At the moment, we calculate that there will be more than 50 prospectuses – each called the Mintos Notes base prospectus.

The Mintos Notes base prospectus defines Mintos-established business structures relating to lending companies, key subjects in these structures, setups of payment flow, risks, duties and responsibilities, terms and conditions, and liabilities. Specific details in the base prospectus relating to the lending company will be:

- Business case

- Financials

- Lending portfolio and statistics

- Underlying assets that ensure proceeds

- Peculiarities and legal environment in the relevant jurisdiction

- Legal and contractual covenants between involved parties

For investors, the Mintos base prospectus primarily tackles the case of information asymmetry, ensuring that information shared with investors and lending companies is balanced and unified. Furthermore, it will help investors in investment comparisons, risk assessment and provide them with access to the required information in the unlikely case of legal issues relating to the structure of an investment-offering setup.

The Mintos Notes base prospectuses will be approved by the FCMC (Latvian Financial and Capital Market Commission), the regulatory body, and a competent authority under the Prospectus Regulation.

The content defined in the Mintos Notes base prospectus

At a basic level, the prospectus includes information that’s defined by regulation. However, depending on the type of public investment offering, every company needs to customize the base prospectus to fit the needs of its users.

The Mintos Notes base prospectus is structured as follows:

Notes base prospectus chapter

Purpose of the chapter

The glossary

Defines subjects of the prospectus and basic terms used in the document

General description

Provides descriptions of key terms used throughout the document, for example, Mintos, Notes, or repayment flows

Risk factors

Detailed mapping of all possible risks related to the investment offering, for example, the financial instrument, borrowers, lending companies, issuer, regulations, and economic environment

General information

Details the management of the prospectus and provides guidelines for the use of the document

Transaction overview

Describes the transaction structure of the Notes which are the subject of the particular prospectus

The issuer

Defines the issuer’s roles and responsibilities relating to the specific investment offering

Mintos

Provides details of the company and structure of other special-purpose vehicles involved in the investment flow relating to the specific investment offering

The lending company

Provides information about the lending company of the Notes’ underlying loans

The loans

Provides detail about the Notes’ underlying loans

Terms and Conditions of the Notes

Defines the Terms and Conditions that apply to the specific Series of Notes

Taxation

Provides a general summary of certain tax considerations for the specific Notes offered in a particular market

Applicable Final Terms

Provides a template for detailed insight into a particular Set of Notes

Base prospectus chapter

Purpose of the chapter

The glossary

Defines subjects of the prospectus and basic terms used in the document

General description

Provides descriptions of key terms used throughout the document, for example, Mintos, Notes, or repayment flows

Risk factors

Detailed mapping of all possible risks related to the investment offering, for example, the financial instrument, borrowers, lending companies, issuer, regulations, and economic environment

General information

Details the management of the prospectus and provides guidelines for the use of the document

Transaction overview

Describes the transaction structure of the Notes which are the subject of the particular prospectus

The issuer

Defines the issuer’s roles and responsibilities relating to the specific investment offering

Mintos

Provides details of the company and structure of other special-purpose vehicles involved in the investment flow relating to the specific investment offering

The lending company

Provides information about the lending company of the Notes’ underlying loans

The loans

Provides detail about the Notes’ underlying loans

Terms and Conditions of the Notes

Defines the Terms and Conditions that apply to the specific Series of Notes

Taxation

Provides a general summary of certain tax considerations for the specific Notes offered in a particular market

Applicable Final Terms

Provides a template for detailed insight into a particular Set of Notes

The Final Terms: An annex to the prospectus

Details that aren’t included in the Mintos Notes base prospectus but are required by the Prospectus Regulation will be in the “Final Terms,” a document that will be created for each Set of Notes. The Final Terms will function as an annex to the Notes base prospectus. While the Notes base prospectus will be accessible from the moment the Notes are ready to be offered under that prospectus, the Final Terms will only become available once a particular Set of Notes is created (daily).

The Final Terms will serve as an “identification card” for a Set of Notes, providing details such as its series number, ISIN code, currency, denomination, price of each Note, issuance date, maturity, interest rate, payment date, the penalty fee, and more.

In addition, the Final Terms will provide information about the pool of loans included in the Set of Notes, for example, loan type, disbursement currency, the total outstanding principal amount transferred to the Issuer, interest rate, late payment interest, grace period, amortization method, extension possibility, limit to the number and total maximum time limit of extensions, and skin in the game.

*****

Lending companies on Mintos will gradually transition to this new setup. As Notes for particular loans become available on the platform, their prospectus will also be released on the Mintos website.

Although a prospectus is a document with high informative value, it should not be considered an investment advice-providing document. Furthermore, its approval by the FCMC regulator is not an endorsement of Mintos or the loan-based investments offered on its platform.

Like any other document of its kind, the prospectus is a risk assessment tool that aims to provide investors with a summary of information to help with the evaluation of investment opportunities. It should be used solely based on the investors’ common sense and risk appetite.

Investing in financial instruments involves risk. There is no guarantee to get back the invested amount.

If you have any questions, let us know in the Mintos Community.

Want to know more about Notes?

No question is left unanswered! If you’re just getting started with Notes, you can begin by reading the must-have information. You can also get insight into how Notes are created and discover the transparency benefits of the Mintos Notes base prospectuses. Or learn about the transition period from claims to Notes, take a deep dive into taxation, find out about the changes to the Secondary Market, and other general questions from investors in the Mintos Investor Q&A. Then, for anything not covered here, you can visit our dedicated Notes Help page.

Still curious to learn more? You’re welcome to share your questions in the Notes thread on the Mintos Community.