Are you interested in how Notes are created on Mintos? This article should help you understand the process! If you’re just getting familiar with Notes, we recommend learning about what Notes are first, then coming back to this article.

Key takeaways:

- Notes are regulated financial instruments backed by loans

- Before Notes can be issued for a lending company’s loans, there has to be a base prospectus that’s approved by the Financial and Capital Market Commission (FCMC) and registered with NASDAQ

- Notes are offered in Sets. To create a Set, several loans with similar properties are pooled together

- When a pool is formed, we send a request to NASDAQ so it can allocate an ISIN for the Set of Notes

- Once a Set has an ISIN, the Final Terms are generated, submitted to the FCMC, and published on Mintos

- Once these steps are completed, a Set of Notes can be placed on Mintos for investment!

What does it mean to invest in Notes?

Notes are regulated financial instruments (or securities) that are backed by loans.

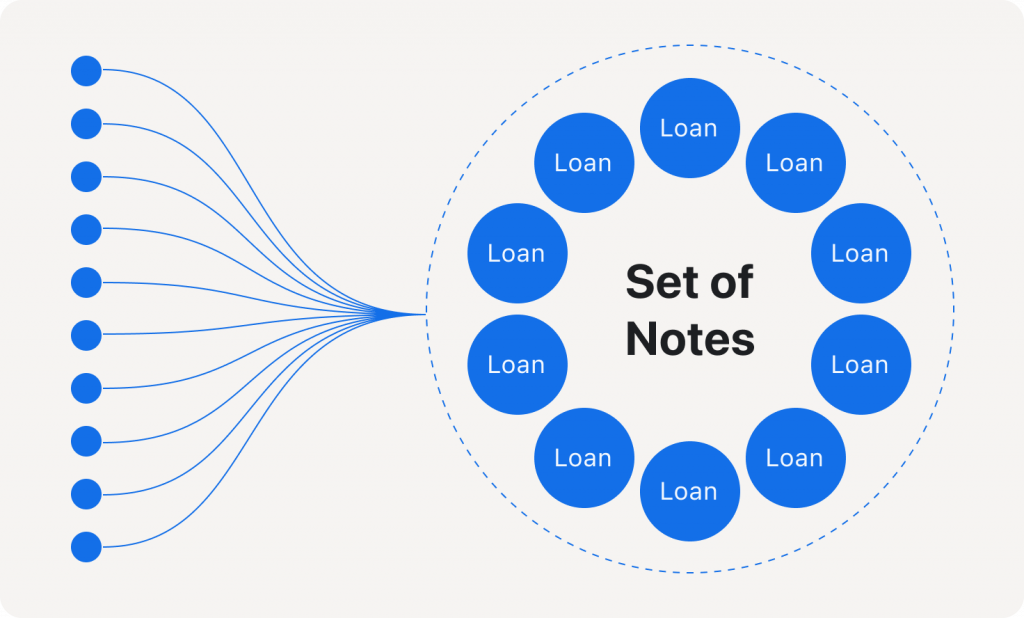

Notes are offered in the form of a Set which is created by pooling several loans with similar properties together (more on this shortly). By purchasing Notes, you’re entitled to receive repayments and interest payments whenever borrowers make payments on the underlying loans.

Notes come in a minimum bundle of 5 000 Notes per Set with a nominal value of €0.01 each. There’s a minimum €50 investment per Set, and each investment provides exposure to all underlying loans in the Set proportional to the loan amount.

In legal documents, a Set of Notes is referred to as a “Notes Series”.

Notes in 4 steps

Step 1: The loans & the issuer

Before Notes, there must be loans! Mintos group does not issue loans to borrowers directly. The investment opportunities on Mintos are based on loans that have been issued to borrowers by lending companies from around the world.

To help fund a loan, a lending company can choose to make it available to the issuer (a special purpose entity owned by Mintos Group), which will create the Notes that investors can invest in on Mintos.

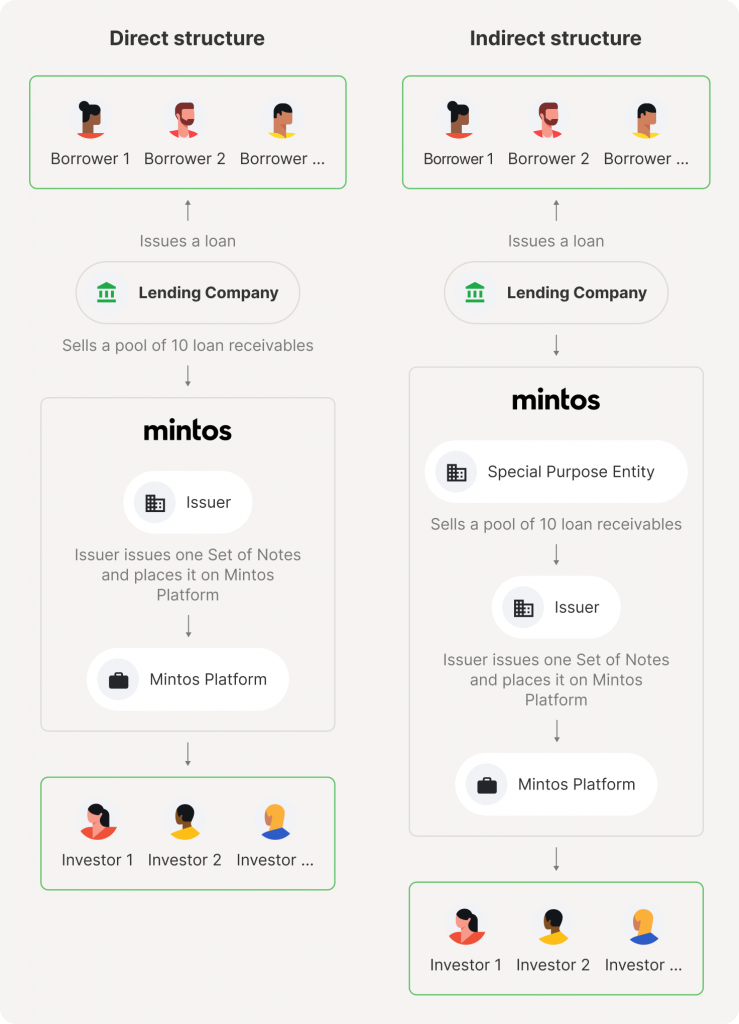

Notes can be created in 2 ways based on these loans:

- In the direct structure, the issuer acquires the title in loan receivables from the lending company that extended these loans to the borrowers.

- In the indirect structure, the loans underlying the Set of Notes are issued to the lending company by a special purpose entity within Mintos group. These loans are collateralized with loans the lending company issued to its borrowers. The indirect structure is applied when there are reasons why the issuer can’t acquire the loans against the borrowers.

Step 2: Mintos Notes base prospectuses

Before the issuer can create Notes for a lending company’s loans, there has to be a base prospectus prepared by Mintos and agreed upon with the lending company. This document aims to help investors make well-informed investment decisions.

When finalized, each Mintos Notes base prospectus needs to be approved by the FCMC (the governing body for prospectus regulation in Latvia) and NASDAQ (the issuer of the unique identifiers for Notes).

Once a base prospectus receives approval, a lending company can start providing investment opportunities to be formed into Notes on Mintos.

Please see our article on Mintos Notes base prospectuses to learn more about this topic.

Step 3: The pooling process

When a lending company provides its loans to Mintos, they must be “pooled” in order to make a Set of Notes.

To create a pool, 6-20 loans with similar properties are grouped together. The number of loans required for each pool differs depending on the lending company.

Each loan within a pool must have the same characteristics:

- Meet a specific loan term range

- Meet a specific loan amount range

- Same interest rate (down to the decimal)

- Same loan type

- Issued in the same country and currency

You can find all of these details in the Mintos Notes Base Prospectus and the Final Terms document for a Set of Notes.

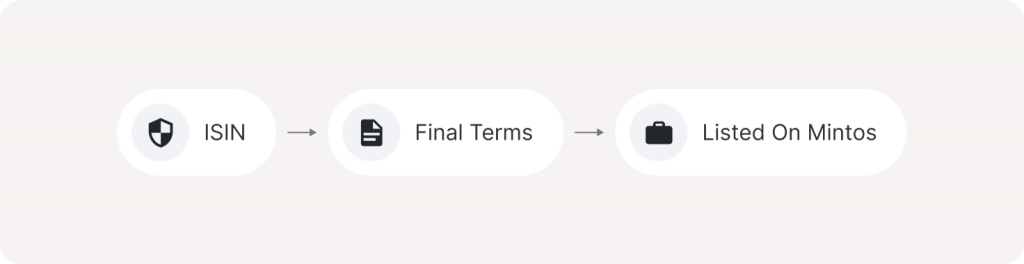

Step 4: Integrating a Set of Notes so it can be offered to investors

When a Set of Notes is formed, we send a request to NASDAQ so it can allocate an ISIN for the Set of Notes. ISINs are used in all mainstream asset classes, such as stocks, to uniquely identify securities.

Once a Set has an ISIN, the Final Terms are generated for that particular Set of Notes, and we submit them to the FCMC. The Final Terms document is unique to each Set of Notes and details specific information about a Set that isn’t already included in the base prospectus.

From here, the Set of Notes can be placed onto the Mintos platform for investment!

A deeper dive into Notes

What happens when you purchase Notes?

You receive repayments and interest payments for the Notes whenever borrowers make payments on the underlying loans.

Each Set of Notes has a payment schedule detailing the expected repayment dates and loan terms for each underlying loan. You can view this in the portfolio section of your Mintos account.

When you purchase Notes, we add a document with all of the transaction information to the portfolio section of your Mintos account.

How is the maturity date set for a Set of Notes?

The maturity date for a Set of Notes is based on the longest individual loan term (plus 10 days). For example, if there were 5 loans maturing in January, then one on 15 March, the maturity for the Set of Notes would be set for 25 March.

Suppose for any reason, the longest loan in a Set is extended past the initial maturity date. In that case, the maturity date of the Set is extended for 180 days, and investors would continue to receive interest for the extended underlying loan. If a Set hasn’t been fully amortized within this extended 180-day period, it would be legally considered as defaulted.

What happens to a Set of Notes if a lending company repurchases a loan?

Loans may be repurchased by a lending company for various reasons. In the case that it happens, if only some loans in the Set of Notes are re-purchased, then the Set will continue to exist, and the remaining loans will continue to amortize as usual. However, if all of the loans underlying the Set are re-purchased, the Set would conclude, and all the invested funds would be repaid to the investor instantly.

To learn more about Notes on Mintos, visit our FAQs.

Want to know more about Notes?

No question is left unanswered! If you’re just getting started with Notes, you can begin by reading the must-have information. You can also get insight into how Notes are created and discover the transparency benefits of the Mintos Notes base prospectuses. Or learn about the transition period from claims to Notes, take a deep dive into taxation, find out about the changes to the Secondary Market, and other general questions from investors in the Mintos Investor Q&A. Then, for anything not covered here, you can visit our dedicated Notes Help page.

Still curious to learn more? You’re welcome to share your questions in the Notes thread on the Mintos Community.