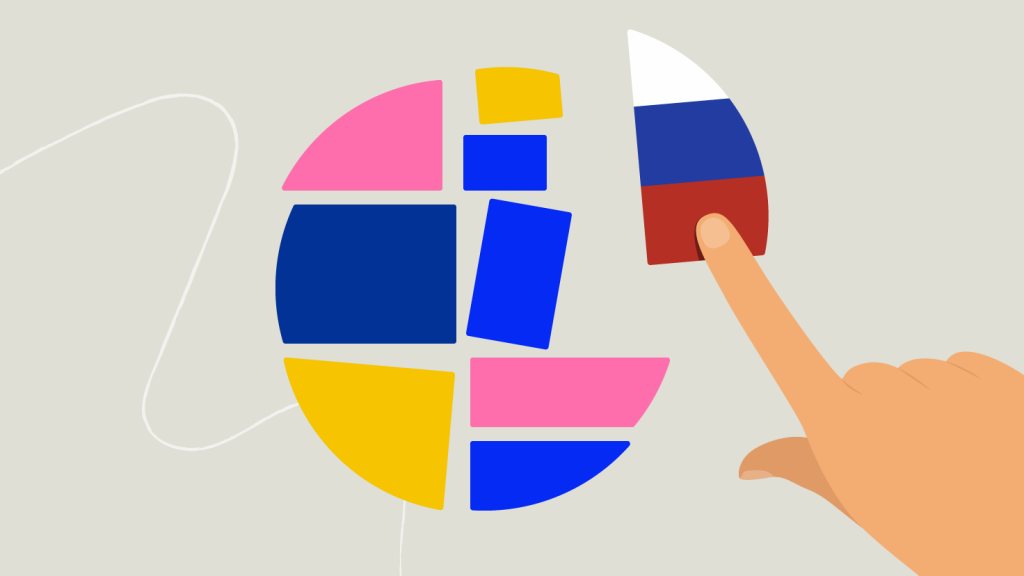

We are working on a detailed insight for investors about the structure of repayment processes from the lending companies from Russia and about the possible outlooks for recovery of funds related to investments in loans from this market. But first, we want to start with a general overview of how sanctions for Russia and the country’s response impact currents of international financial markets. The effects are extending to anyone with exposure in Russia, from the largest banks and investment funds to companies like Mintos.

Sanctions imposed and responses from Russia

As Russia launched its war on Ukraine on 24 February 2022, the international community launched its counter reactions to limit Russian access to the economic currents of the Western world. One month later, these responses seem like the fastest exclusion of a whole economy from the global financial markets.

The United States, the United Kingdom, the European Union, and countries around the world have introduced sanctions and various measures, preventing Russia from accessing funds and resources that can further empower its army.

Russia is largely cut off from accessing the international financial system. With the agreement to disconnect 7 major Russian banks from the international SWIFT system, other sanctions are introduced in an effort to force political change and weaken Russia’s ability to continue the war. US companies and individuals are banned from doing any business with the Central Bank of Russia, a move that led to freezing almost half of the country’s foreign currency reserves. Over the past weeks, around $640 billion in gold and foreign exchange reserves of Russia has been put to freeze. While the Central Bank of Russia holds over 2 300 metric tons of gold, the sanctions are keeping potential buyers at bay as the ruble dramatically plummeted since the launch of the attack on Ukraine.

As the war in Ukraine continues, the sanctions list gets longer. American president Joe Biden has ordered a ban on all imports of Russian fossil fuels and oil, while some European countries still don’t have a clear position on banning the import of gas, as the continent is much more dependent on Russian natural resources. As the strongest European economy, Germany imports close to half of its gas from Russia. An instant total embargo on the Russian gas is perceived as a risk for the German economy with impacts on the whole market, hence a potential recession in the EU. With the latest demand of Russia for all gas imports to be paid in rubles, a move that’s seen as “a breach of contract” by the German and other international officials, countries are now exploring ways to expand their supply chains beyond dependency on Russian resources.

The sanctions affect various industries and communications established over the years of doing business with Russia. A ban on the major Russian media outlets, the freeze of assets of Russian oligarchs, airspace ban for Russian airlines and private jets, or high alert for cryptocurrency exchange markets are some of the measures with which the West blocks Russia from participation in the worlds’ currents. Further on, export controls are introduced for electronics, computers, information security, sensors, lasers, aircraft equipment, and even technology for oil refineries.

The downward spiral for RUB and the Russian GDP

Hundreds of international companies have left, or are in the process of leaving, the Russian market. Over the course of one year, millions of Russians could become jobless.

At the same time, billions of dollars from financial industry players are at stake and locked in Russia – just Raiffeisen Bank International AG, Citigroup, and Deutsche Bank together have about $100 billion exposure in the country. Local investment managers report that what was a $6 billion portfolio of pension funds is now worth only a fraction.

Russian listings were removed from the FTSE Russell index business indices, and 27 Russian listed securities were suspended on the London Stock Exchange. Even by that moment, some of the most prominent Russian stocks on the global exchanges have lost almost all of their value: Sberbank was down 99.72%, Gazprom 93.71%, Lukoil 99.2%, Polyus 95.58%, Rosneft 92.52%.

Russia has delayed facing the internal stock market reality, as the country’s major stock exchange was closed from the beginning of the war until 24 March, when it finally reopened for a shortened trading session and with a ban on short selling, and only for USD and RUB. Also, foreign investors are banned from exiting the market until 1 April, and even then, the investors’ money in the two currencies must remain in Russia.

Over the past few weeks, the ruble has lost around 30% of its value, with a lot of volatility and unpredictability in its dynamics in recent days. Inflation, growing unemployment, and a drop in GDP are expected to put the most weight on the ordinary people of Russia and those already living in poverty or at the brink of it.

S&P Global Market Intelligence reports that Russia is facing its “deepest recession since the 1990s”, with the prediction of a GDP decrease of around 20% this year. The insulation of Russia also puts bottlenecks on logistics already affected by the pandemic, and on the local production industries. With a higher rate policy introduced by the Russian Central Bank, Russia is maintaining its financial system by making money withdrawal from the banks more expensive, but the Russian retaliation policies are already causing a significant drop in loans due to higher borrowing costs. The Central Bank of Russia states that businesses will need support from the state lending programs to narrow the gap caused by the hit of sanctions and the responding Russian internal policies.

The Russian retaliation also includes a ban for foreign persons from selling Russian securities, while Russian entities are banned from making payments in foreign currencies to service their debts in foreign markets.

The impact on Mintos

The troubles of international financial market players in relation to Russia also translate to Mintos as an investment firm with long and successful business relations with the Russian lending companies over the course of the past 7 years. The ban on foreign currency transfers also includes the lending companies that previously offered loans for investments on Mintos. The €70 million exposure of Mintos investors in Russia is around 15% of the total outstanding investment amount on Mintos, and involves borrowers’ repayments due to many investors on our platform.

While we can’t predict the outcomes of the war or its end, we are working daily to assess possible ways for debt management going forward, while being compliant with sanctions and applicable regulations.

In the following week, we will share more about how the transaction system from Russian lending companies to Mintos works, which main current challenges we are currently facing for payments, and what kind of scenarios we can anticipate when it comes to the future of funds due to Mintos investors by borrowers of the Russia-issued loans.

We welcome you to share your comments and questions in the Mintos Community, and we will try to include them in the upcoming article, or answer them in the Community.