Goals are proven to have an energizing role in life, and the higher the goal, the greater the effort you’re likely to put in1. By having investment goals, you’re more likely to hold onto your better-performing investments for longer because your focus is on achieving your objectives rather than the gains or losses of individual investments2.

This article outlines common investment goals, how you can set them, and how you could align them with investments and risk tolerance.

Key takeaways:

- Investment goals are set based on current and future financial circumstances and depend on income, age, and future outlook

- Goals can be set using the SMART framework

- Risk tolerance is not only defined by personal preference but also the risks required to achieve each objective

- Asset allocation is where you choose how much you will invest in which investments, based on your goals

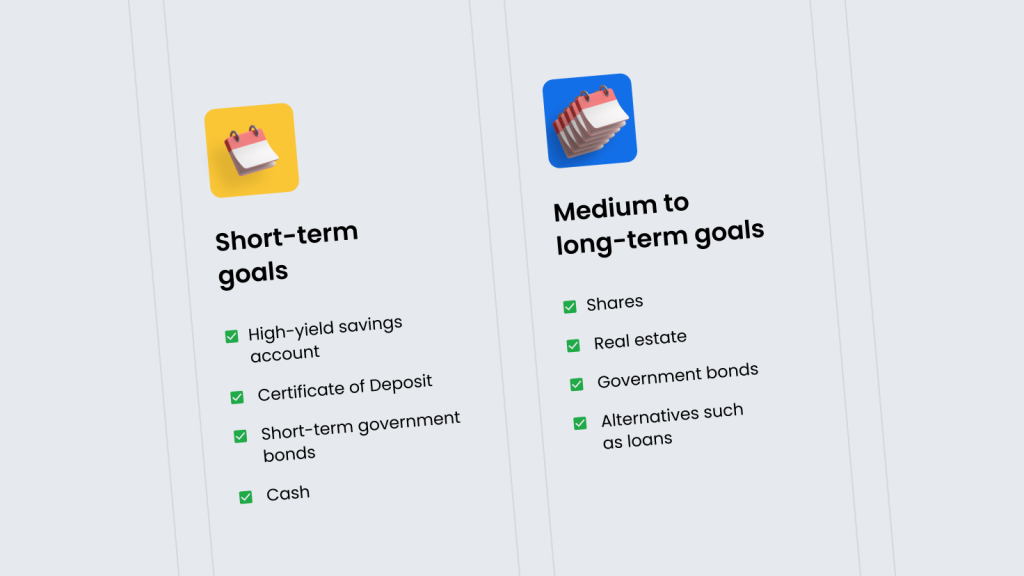

- Short-term goals (3 – 12 months) focus on preserving capital and are only suited to certain types of investments, whereas medium to long-term goals focus on wealth generation

Why set investment goals?

Over the years, researchers have seen that many investors, regardless of experience, tend to sell successful investments while holding onto losing investments – something that’s called the “disposition effect”2. This happens because we’re influenced by many things when making investment decisions: our jobs, where we live, and the media2. A study on this effect showed that investors were 50% more likely to sell successful stocks than losing stocks3. As a result, total investment returns over time can be much lower.

A proven way to reverse this effect, however, is by setting investment goals. With a goals-based investment approach, instead of making financial decisions that focus on the outcomes of individual investments, you look at what’s required to meet your overall goals. This approach can help investors to meet their future financial responsibilities by generating long-term wealth.

How to set investment goals

To begin setting your own goals, it’s good to gain an understanding of the things you need to afford now and would like to afford in the future. For investors, factors such as income, age, and future outlook all influence motivations for investing.

Income is the source of your investing and fluctuates depending on your stage of life. So thinking about current and future financial responsibilities can help shape investment goals. As well as this, age can determine current and future needs, such as buying your first home, university fees, or retirement, all of which influence your goals’ time-frames. However, ultimately, you can set goals based on your outlook and motivations for the future. Some examples of common investment goals are:

- Short-term goals: Lifestyle aspirations (holidays, cars, or a rainy day)

- Medium-term goals: Significant life costs (school fees or purchasing property)

- Long-term goals: Financial independence or retirement planning

Over 500 studies have shown that people who set specific, challenging goals perform better than those who set “non-specific or “do-your-best” goals”.4 The following SMART framework has real relevance when it comes to setting investment goals. A SMART goal is:

- Specific: Clear and well-defined

- Measurable: Can be measured by a specific outcome

- Achievable: Needs to be practically achievable

- Relevant: Has real relevance to what you want to achieve

- Time-based: Defined by a time-frame

From here, you can set a budget for each goal. Sticking to a budget can be difficult, so ideally, the budget is realistic and affordable. It can be helpful to re-evaluate money management techniques and create strategies such as direct debits or dedicated savings accounts.

Importantly, setting investment goals doesn’t mean you have to make life-altering changes. Minor adjustments can go a long way to generating wealth in the future.

How to choose investments that align with your goals

Risk and investment goals

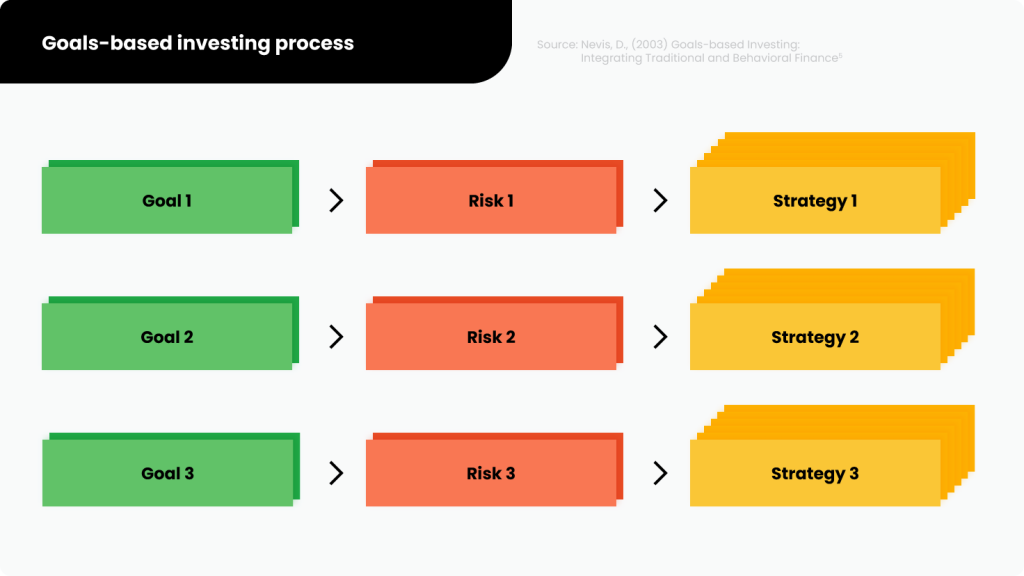

Instead of making investments based only on personal risk tolerance, it’s also essential to consider the level of risk required to meet each goal. For example, a natural risk-taker may have an investment goal that only requires a conservative investment strategy.5 Investors often approach risk and their goals as follows:

- Short-term goals: If an investors’ goal is to preserve capital in the short-term, this would require a low-risk approach and, therefore, a more conservative investment strategy.

- Medium to long-term goals: A moderate strategy may suit goals requiring a higher balance of risk and return than a conservative strategy, depending on your risk tolerance. Furthermore, an aggressive approach can suit longer-term goals where investors are willing to accept higher levels of risk for higher returns.

Asset allocation

Asset classes provide different benefits depending on the time frame and risk required to achieve each goal. For instance, if your goal were to buy a new car, you would have a short-term time horizon. Short-term investments usually provide lower returns but are highly liquid, and you can generally cash out your money within 3 – 12 months. This scenario aims to protect short-term capital while generating returns, so it’s considered safer to invest in asset classes that are almost risk-free, such as:

- High-yield savings account

- Certificates of deposit

- Short-term bonds

- Cash

For goals with a medium to long-term time horizon, however, investors aren’t planning to need the money invested straight away, so the focus shifts from protecting short-term capital to future wealth generation. The main benefit of longer-term investments is that returns can be much higher. They can also help to overcome investment obstacles by “riding out” peaks and drops in the market, providing more consistent returns over time. When it comes to investing on Mintos, for example, we’ve found that our investors tend to earn more consistent returns over a longer time period. The following asset classes tend to be more volatile (higher-risk) or require longer investment terms and are therefore better suited to longer-term goals:

- Shares (also known as stocks or equities)

- Real estate or REITs

- Medium and long-term bonds

- Commodities

- Alternatives such as loans

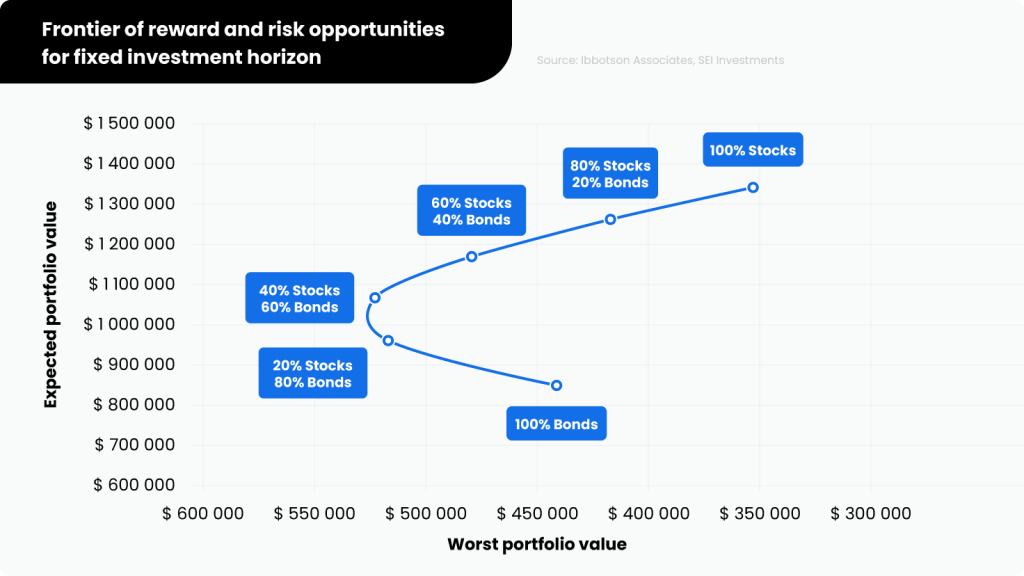

An effective way to approach asset allocation is to have a balanced mix of asset classes that match each longer-term goal’s time horizon and risk tolerance. Because many asset classes are uncorrelated, having a combination of them can protect your portfolio from downturns in the market – a strategy called diversification.

With diversification, your higher-performing investments should ideally outweigh your lower-performing investments by spreading risk across multiple uncorrelated investments and asset classes. On Mintos, for instance, we’ve seen that investors with highly diversified loan portfolios tend to achieve more stable returns on average – take a look at our page on diversification and returns.

Furthermore, investing only in stocks, for example, hasn’t historically provided consistent returns over long periods. That’s not to say stocks shouldn’t be included in an investment strategy, but it shows how having a balance of other asset classes can be key to achieving longer-term goals.

Setting investment goals is a personal investment in many ways, but achieving them can mean financial freedom in the future. Goals are moving targets, so the key to goals-based investing is to stay focused on the overall outcome while adjusting investment strategies along the way.

All information published in this post is for informational purposes only, and should not be considered investment or legal advice. This information is not intended as an advertisement, solicitation, offer, or recommendation to buy or sell any investment, or to engage in any other transaction. Any investment decision must be based on an analysis of the risks related to the investment. Before investing in loans and other investments, consider your knowledge, experience, financial situation, and investment objectives.

1 Locke, E. A., & Latham, G. P. (2002). Building a practically useful theory of goal-setting and task motivation: A 35-year odyssey. American Psychologist, 57(9), 705.

2 Barber, B. M., & Odean, T., (2011). The Behavior of Individual Investors.

3 Wierzbitzki, M., & Seidens, S., (2018) The Causal Influence of Investment Goals on the Disposition Effect.

4 Seijts, G. H., G. P. Latham, K. Tasa, B. W. Latham, and M. Journal (2011). Goal Setting and Goal Orientation: An Integration of Two Different Yet Related Literatures. Academy of Management Journal 47 (2), 227–239.

5 Nevis, D., (2003) Goals-based Investing: Integrating Traditional and Behavioral Finance. SEI Investments.