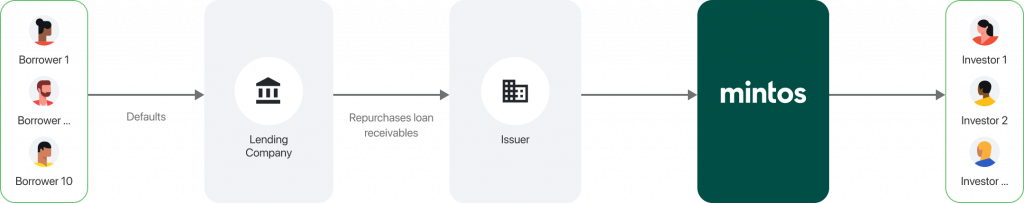

A buyback obligation is a credit enhancement given by either the lending company or another entity of a lending company group to the loan security issuer for a particular loan. In cases where the borrower is late, the lending company is directly obliged to buy back the loan from the issuer at nominal value plus accrued interest. Usually, this means that the investors receive proceeds from the loan securities for a loan that is late, even in case of borrower default.

Depending on the cooperation structure between Mintos and the lending company, the buyback obligation is executed in slightly different ways, with the same end result: the investor will get their money. There is either a direct or indirect structure between the lending companies and Mintos.

Buyback obligation in a direct structure

If any payment under any of the relevant borrowers’ loans is more than 60 days late, the lending company (or any other entity, if specified in the prospectus) must repurchase the relevant loan receivables from the issuer. Investors should receive money when the issuer has received the payment.

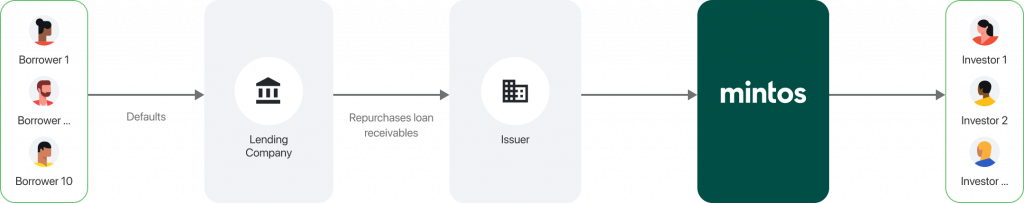

Buyback obligation in an indirect structure

The lending company is obliged to either repurchase the relevant loan receivables from the issuer or repay them to the special purpose entity (SPE) if any payment under any of the relevant borrowers’ loans is more than 60 days late.1 Investors should receive money once the SPE transfers the buyback assets to the issuer.

Limitations of the buyback obligation

While investing in loans with a buyback obligation could reduce the potential loss for the investor in case of a borrower default, the buyback obligation is only as good as the lending company undertaking this obligation. If the buyback provider fails to honor its obligation, the investor is directly exposed to the risk of the borrower not making loan repayments.

All loan securities listed on Mintos include a buyback obligation.

Buyback strength scores on Mintos

The buyback strength score is a subscore of the Mintos Risk Score, updated quarterly. This score aims to help investors make informed decisions on Mintos. We evaluate the buyback strength score based on the buyback obligor’s ability to fulfill contractual obligations, meet liquidity needs, and capital sufficiency.

More about Mintos Risk Score.

1 The SPE is a separate legal entity involved in the deal to isolate financial risk.