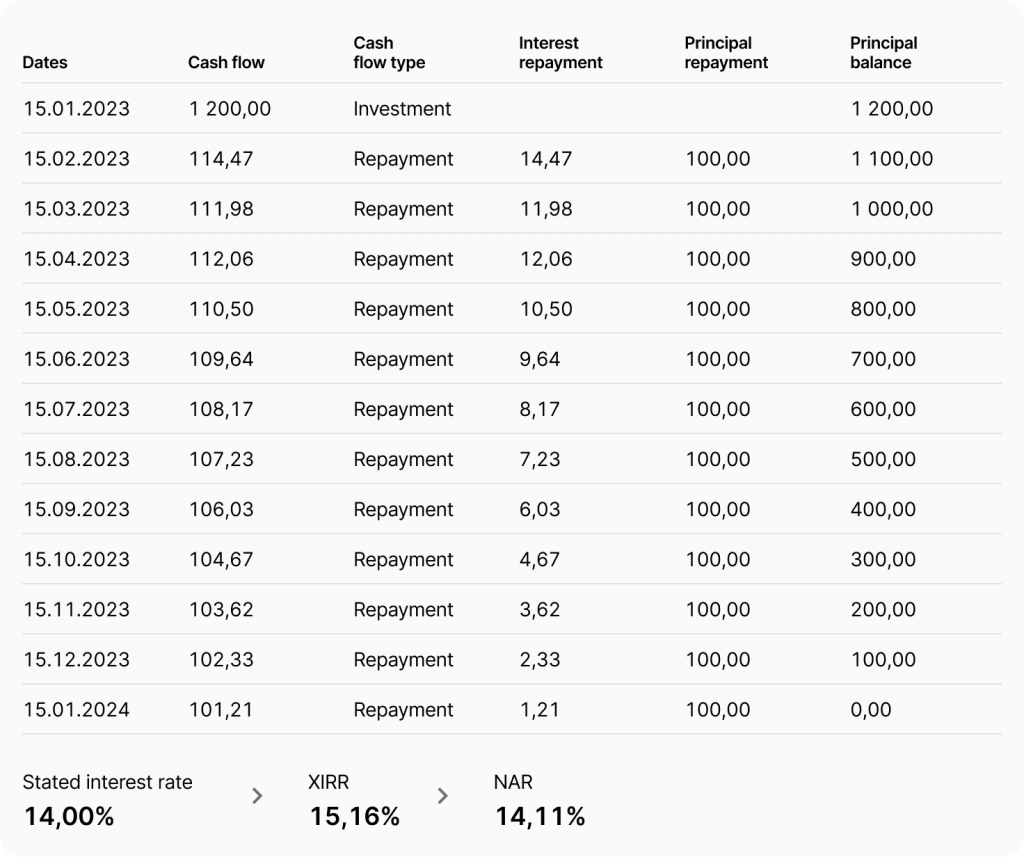

Net Annualized Return (NAR) is a financial metric used to measure the annual rate of return on an investment after accounting for all expenses, fees, and losses. The NAR provides investors with a clear understanding of the actual return they can expect from their investment over a specific period, typically on an annualized basis. The NAR is not a prediction of performance, rather it includes anything in the past that has affected your returns.

Here’s how NAR is calculated:

- Start with the initial investment amount.

- Add any returns or gains generated by the investment over the specified period.

- Subtract any expenses, fees, or losses incurred during the same period.

- Calculate the annualized return by adjusting the return or loss to an annual rate, taking into account the time period of the investment.

NAR is particularly useful because it factors in all costs associated with the investment, providing a more accurate representation of its performance. This allows investors to compare the returns of different investment opportunities more effectively and make informed decisions about where to allocate their funds.

The NAR on Mintos

The NAR value you see on your Mintos Overview page measures the annualized rate of return of all your investments since you started with Mintos. The NAR is not a prediction of performance. It’s only calculated for the amount of money that you have invested with Mintos. Funds available in your Mintos account that are not invested are not included in the calculations.

The NAR includes anything in the past that has affected your returns, such as any delays, defaults, or campaign rewards. The NAR reports as a nominal interest rate (the stated interest rate of a financial instrument).

Limitations of the NAR

The NAR doesn’t take into account the following:

- Compounding interest

- Change in market value

- Expected future losses

- Amounts overdue, not yet categorized as bad debt

NAR calculations don’t take into account provisions for a loss in value or expected future losses. Any past losses resulting from an unsuccessful or partially successful recovery of funds are reflected in the NAR calculation only after the recovery process is finalized, and any irrecoverable funds are marked as bad debt.

Funds invested in suspended loans are included in your NAR, up to the point where they are declared as unrecoverable.