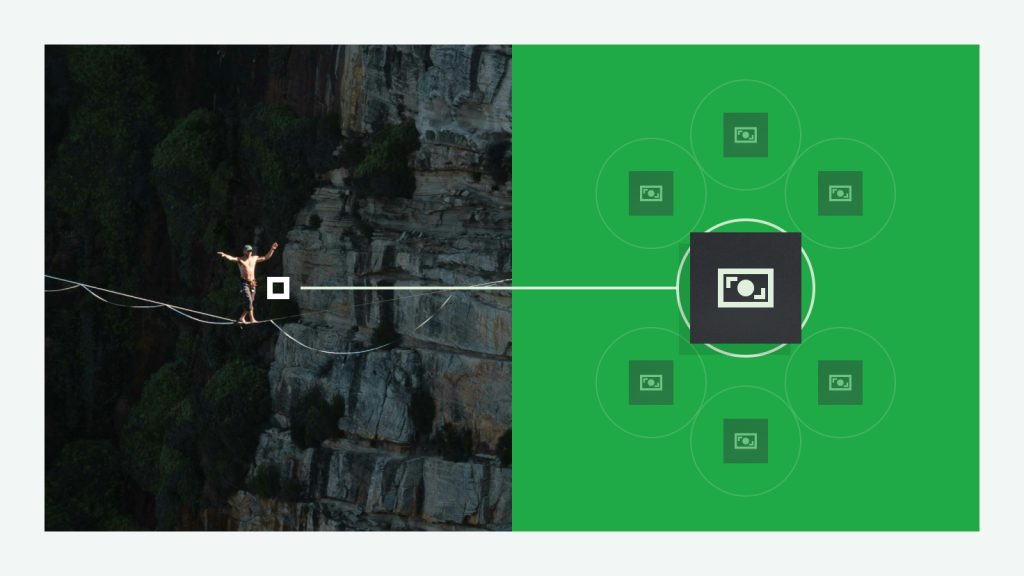

As the investment landscape evolves, new trends, asset classes, and a changing macroeconomic environment alter traditional investing norms. So when it comes to achieving investment goals, the balance between risk and return has become a critical consideration.

With new trends, emerging asset classes, and fluctuating economic conditions, traditional norms for managing risk and maximizing returns are evolving. To make smart investment decisions, we suggest investors familiarize themselves with risk and return in investments. This article offers a detailed look at various asset classes to explain the risk-return tradeoff and help investors manage risk in investing, particularly in 2026’s unique market environment.

For those looking to build a diversified portfolio, understanding how to calculate risk and return can be a game-changer. By gaining insight into high-risk, high-return investments versus low-risk, low-return investments, investors can better match their financial goals with their risk tolerance.

To deepen your knowledge, read our guide on risk diversification and learn more about the Mintos approach to managing risk and return in investment portfolios.

In this guide, we’ll cover

✔ Risk and return in investments

✔ Risk vs. return across asset classes

✔ How to calculate risk and return

✔ Examples of risk and return in investing

✔ Risk-adjusted return and why it matters

✔ High-risk, high-return vs. low-risk, low-return investments

✔ Managing risk in investing today

✔ Investment strategies for 2026 and beyond

Risk and return in income-producing assets

Stocks (Equities)

Stocks continue to be a go-to asset class for global investors. With above-average returns, this asset class has stood the test of time, making stocks a strong example of high-risk, high-return investments.

Can past performance predict future returns?

While past performance is often referenced in evaluating stocks, it has both its strengths and limitations. Looking at historical data helps capture patterns across economic cycles, offering a reasonably accurate picture of how stocks might perform under similar conditions. Research also suggests that stocks priced lower relative to their earnings tend to achieve higher future returns.

However, relying too heavily on historical data has its drawbacks. Over longer periods, shifts in economic conditions, changes in accounting standards, and evolving market dynamics can all impact the accuracy of predictions.

What are the factors influencing stock returns?

Various business and sector-specific factors influence stock returns, some broader economic and regulatory factors also play a significant role. These assume that investors act rationally—taking only systematic and market risks into account. In reality, investor behavior can be unpredictable, and sentiment significantly impacts returns.

For more on balancing risk and return in your investment strategy, see our article on investment strategies.

Real estate

Real estate remains a popular choice for diversifying investment portfolios because of its ability to hedge risk. Not only against other asset classes like stocks and bonds but also against broader economic risks, including inflation.

Returns have varied significantly year-on-year, highlighting real estate’s risk-return tradeoff as both an income-producing and inflation-resistant asset class. For those seeking passive real estate investing strategies, balancing risk and return is key.

What factors influence real estate returns?

1. Market and regulatory factors: These include influences from global markets, local economic shifts, and changes in regulations.

2. Property-specific factors: These encompass physical, operational, and financial considerations tied to each property.

Understanding risk and return in real estate also means being aware of how unexpected costs—such as those from regulatory changes or information gaps regarding market fundamentals—can impact returns.

For passive real estate investors, these factors are especially important, as they can significantly affect both income stability and long-term growth.

How is climate change shaping real estate risk?

Real estate investments are susceptible to changes in the physical environment – something that’s evolving faster than ever before. From rising maintenance budgets to new costs related to sustainable energy requirements, environmental changes are rapidly altering the risk-return tradeoff in this asset class. Climate-related adjustments are becoming more costly, with some regions facing greater property risks than ever before. These trends are crucial for risk and return in investments as investors evaluate long-term real estate performance.

To dive deeper into passive real estate investing, see our guide on what is passive real estate investing.

Bonds

Bonds are a staple in diversified investment portfolios because of their historical stability and utility as risk-hedging assets. However, the dynamics of bond returns are evolving, with risk-adjusted returns impacted by inflation and economic shifts.

What factors influence bond returns?

Government bonds are generally seen as low-risk, low-return investments, often used to hedge risk in portfolios. Yet, rising inflation has put downward pressure on nominal bond returns, as they lack inflation protection. As inflation persists, the risk-return tradeoff becomes more pronounced, potentially reducing the benefits of traditional government bonds in diversified portfolios.

This situation has prompted some investors to turn to inflation-linked bonds, which offer more consistent returns during inflationary periods. Inflation-linked bonds may be especially valuable in today’s economic climate, as their risk-adjusted returns remain stable despite inflationary pressure.

Bonds on Mintos: A flexible alternative

At Mintos, investors can access a curated selection of bonds, with a low minimum investment of just €50. Unlike traditional bond investing which requires large capital outlays, Mintos makes it easier for retail investors to gain exposure to bonds and stabilize your portfolio with a less volatile asset.

Investors earn regular coupon payments and have the option to sell their bonds on the Mintos Secondary Market, providing liquidity and flexibility when managing risk and return in investments.

How does investing in bonds work?

When you invest in a bond on Mintos, you’re purchasing a financial instrument that pays regular interest, known as coupon payments, until maturity. At the end of the term, you’re expected to receive the bond’s face value, subject to the issuer’s ability to meet their obligations. This predictable income can help stabilize your portfolio and improve your risk-return tradeoff, especially when combined with other assets.

What are the benefits of bonds on Mintos?

1. Affordability: Start investing in bonds from just €50, making it easy to diversify across multiple issuers and industries even with limited capital.

2. Liquidity and flexibility: Bond-backed securities listed on Mintos can be sold on the Secondary Market, so you’re not necessarily locked in until maturity. This adds flexibility for adjusting your portfolio or accessing funds when needed.

3. Enhanced diversification: Adding bonds to your investment strategy can reduce overall portfolio risk. This helps improve your risk vs. return balance, especially for those looking to stabilize returns without taking on too much risk.

How bonds fit into a diversified investment strategy

For investors seeking stability, bonds can serve as a stabilizing force in a diversified portfolio, complementing higher-yielding or more volatile assets like equities. In 2026, with increased market uncertainty, bonds can play a key role in managing risk in investing and achieving a more predictable outcome.

To learn more about how bonds can help with understanding risk and return and how they fit into investment strategies for 2026, check out our full guide on bond investing. It’s a great place to start if you’re looking to optimize your risk vs. return in today’s market.

Investing in Loans

Alternative income-producing assets, like loans, have become increasingly popular among investors seeking higher returns. Traditionally, the loan investment market was limited to banks and large institutions. However, thanks to platforms like Mintos, retail investors worldwide now have access to loan investments, opening up new possibilities for risk and return for beginners, as well as seasoned investors.

On Mintos, investors benefit from the unique advantages of loans as an asset class, particularly through Mintos’ convenient access to diversified loans across multiple regions and borrower profiles. Loan investments offer a steady income stream and add diversification to portfolios by improving risk vs. return dynamics.

What factors influence returns on loan investments?

Like most investments, investing in loans involves some level of risk. Here are the main factors that influence loan investment returns:

1. Loan-specific risks: Sometimes, borrowers may miss payments or repay loans early, which can reduce investor returns. In cases of borrower default, a lending company might not recover the entire amount owed, impacting repayments.

2. Lending company-specific risks: The financial health of lending companies directly affects loan investments. A lending company may face operational challenges or even bankruptcy, which can impact its ability to meet obligations such as buybacks or timely payments to investors.

3. Regulatory and compliance risks: Lending companies and investing platforms operate under country-specific laws and regulations. Changes in these standards can impact business operations and, in turn, investor returns.

How do loan investments fit into a diversified portfolio?

For those building a diversified portfolio, loan investments offer a compelling example of the risk-return tradeoff. Loans tend to have a low correlation with other asset classes like stocks and bonds, helping investors achieve a more balanced risk and return in investment portfolios. On Mintos, many lending companies offer a 60-day buyback obligation, providing an additional layer of security for investors by helping to mitigate some common risks in loan investing.

With these unique attributes, loan investments are a valuable addition for beginners and experienced investors alike, serving as examples of risk and return in investing through varying levels of risk and potential return. This makes them particularly relevant in today’s market, where understanding risk and return and adjusting your approach to risk vs. return are more important than ever.

To learn more about the Mintos approach and start exploring loan investments as part of your investment strategy, see our article on how to invest in loans.

ETFs (Exchange-Traded Funds)

ETFs offer a simple, cost-effective way to gain exposure to a wide range of assets, from stock indexes to industry sectors and even commodities. They’ve become a core component of many diversified portfolios, particularly for passive investors.

ETFs are usually considered lower-risk, lower-return investments compared to individual stocks, although their risk and return depends on the assets they track. For example, an ETF tracking government bonds will have different characteristics than one focused on emerging markets or technology stocks.

In terms of the risk-return tradeoff, ETFs are often seen as balanced. They provide risk-adjusted returns through built-in diversification, making them a smart choice for investors who want to balance risk and return without picking individual securities.

If you’re new to investing or exploring risk and return for beginners, ETFs can be a practical entry point.

Commodities

Commodities, like natural gas, oil, and agricultural products, are physical assets that tend to behave differently from traditional financial investments. This makes them powerful tools for diversification and managing exposure to macroeconomic risk and return.

Historically, commodities have shown a high-risk, high-return investment profile. Their prices are influenced by global supply and demand, geopolitical tensions, and weather events. As a result, they can be highly volatile, but also serve as a hedge, especially during inflationary periods or economic uncertainty.

For investors looking to round out their portfolios, commodities represent an alternative way to optimize risk vs. return in a volatile market. And when used strategically, they can enhance the risk-adjusted return of a well-balanced investment strategy.

To explore alternative investments for diversification, commodities may offer a compelling, if more volatile, path.

> What are alternative investments?

How is risk and return calculated?

At a basic level, return is what you earn on an investment, usually expressed as a percentage. For example, if you invest €1 000 and earn €100 in a year, your return is 10%.

Risk is the possibility that your return will differ from what you expect, often measured by volatility (how much an asset’s price or return fluctuates over time). The more it swings, the higher the risk.

A common way to evaluate them together is through the risk-adjusted return. This tells you how much return you’re getting for each unit of risk. A higher risk-adjusted return means you’re being compensated well for the risk you’re taking.

Imagine two investments:

- Investment A returns 8% per year on average, but its value doesn’t fluctuate much. One year it might return 7.5%, another year 8.5%, but it stays steady.

- Investment B returns 12% per year on average, but it’s highly volatile. Some years it jumps to 20%, others it drops to -5%.

At first glance, Investment B seems more attractive because it offers a higher return. But the swings mean it’s also riskier as you might not get that 12% in any given year. If you’re relying on predictable income or trying to avoid losses, that volatility could be a deal-breaker.

Now, when you calculate the risk-adjusted return, you’re essentially asking: “How much return am I getting for each unit of risk I’m taking?”

In this example, Investment A might have a higher risk-adjusted return, because it delivers steadier performance relative to its risk. Investment B, while potentially more profitable, requires you to accept much more uncertainty.

So even though Investment B has the higher raw return, Investment A might actually be the smarter choice depending on your goals, especially if you’re focused on managing risk in investing or building passive income with low risk in 2026.

Want to dive deeper? Tools like the Sharpe Ratio and standard deviation are often used for more advanced analysis.

How to navigate risk and return in a changing market

In 2026, investors face a different kind of challenge, not just picking the right asset class, but interpreting risk and return through a new lens.

Macroeconomic risk and return factors like persistent inflation, shifting interest rates, and global policy changes are altering how traditional assets behave. Meanwhile, climate risk and investments are increasingly linked. For example, long-term real estate and infrastructure projects now come with exposure to environmental disruptions and regulatory pressures tied to sustainability.

Against this backdrop, investors looking for passive income with low risk in 2026 are reevaluating where stability really lies.

What often trips up investors isn’t a lack of knowledge, it’s relying too heavily on historical assumptions. Risk isn’t static. What looked like a low-risk, low-return investment five years ago might carry different exposure today. Similarly, some high-risk, high-return investments now offer less upside than expected due to tighter margins or market saturation.

To move forward with confidence, it helps to sharpen your toolkit:

- Learn how to calculate risk and return with updated metrics that reflect today’s conditions, not just yesterday’s data.

- Revisit your portfolio with a focus on risk and return analysis across asset classes.

- Explore alternative investments for diversification, especially those offering non-correlated income streams.

Use our resources to understand risk and return in a volatile market, and how Mintos can help you balance risk and return in your personal strategy.

Balance risk and return with Mintos on your investment journey

Mintos empowers investors to access a wide range of assets, making it easier to tailor a portfolio that matches individual risk tolerance and return expectations. For beginners new to risk and return, or investors seeking portfolio enhancement, Mintos offers a streamlined platform with tools designed for both simplicity and customization.

Investors on Mintos can benefit from diversified, income-generating options across global markets, alongside a variety of automated investing features. These tools help minimize the hassle of managing each investment and support a hands-off approach to passive income generation, a valuable choice for those balancing other commitments.

If you’re aiming to build a portfolio that performs well in the current market environment, Mintos can help you achieve this by offering resources and insights, including guides on setting financial goals, a long-term investments guide, and low-risk investments. Mintos makes it easy to approach risk and return in 2026 with confidence, drawing from our data-driven insights, real-time market updates, and extensive educational materials.

Ready to get started? Explore investment options on Mintos today and begin building a portfolio that aligns with your financial goals and helps you achieve a balanced approach to risk and return.

Want to learn more?

Disclaimer:

This is a marketing communication and in no way should be viewed as investment research, investment advice, or recommendation to invest. The value of your investment can go up as well as down. Past performance of financial instruments does not guarantee future returns. Investing in financial instruments involves risk; before investing, consider your knowledge, experience, financial situation, and investment objectives.