Welcome to a new edition of Mintos affiliate news. Our goal is to provide you with important updates, sneak previews, and other interesting information for your audience. To avoid duplicate content on search engines, we ask you to make this content your own and modify it. A copy or duplication of the content is prohibited.

Get ready to invest: Learn the basics

Investing can foster one of the most integral parts of life: growth. So if you’re looking to build long-term wealth and create the financial means to achieve life-long goals, investing can be the key to unlocking these freedoms. To get you started, we’ve put together an overview of what investing is, what people invest in, how people invest, and what you might need to start your investment journey.

Key takeaways:

- Investing can be an effective way to build long-term wealth and unlock financial freedom

- When you invest, you can expect to earn a profit on the money you have invested, otherwise known as an investment return

- Investment returns compound (grow bigger and bigger) each time you reinvest them, helping you to reach financial goals faster

- Investments are referred to as assets, which are grouped into asset classes, such as cash, stocks, bonds, real estate, commodities, and alternatives

- Anyone can start investing, regardless of experience or financial situation. Even just a little money can go a long way.

What is investing?

Whether consciously or not, we constantly invest throughout our lives, whether it’s our time getting a university degree or our energy learning how to cook a new recipe. Often, we do these things because we expect them to bring us value in the future, such as landing that dream job after finishing university. When it comes to the financial side of investing, the concept’s very similar: you put money into something with the expectation that you’ll achieve a financial profit in the future.

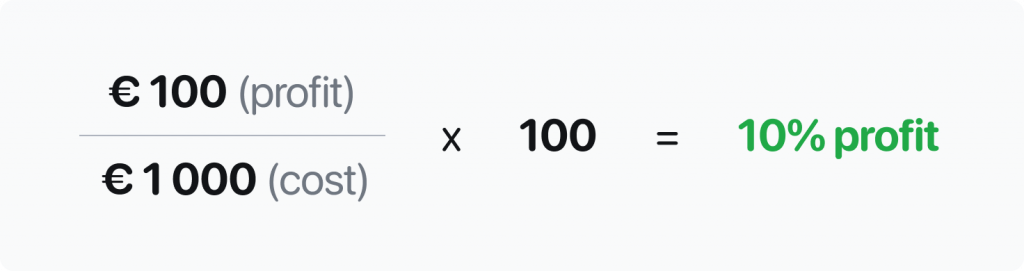

The profit you earn from financial investments is commonly referred to as an investment return, which is expressed as a percentage. For example, if you were to invest €1 000 in something and at the end of the investment period, you get back €1 100 – your profit is €100, giving you a 10% investment return.

Why do people invest?

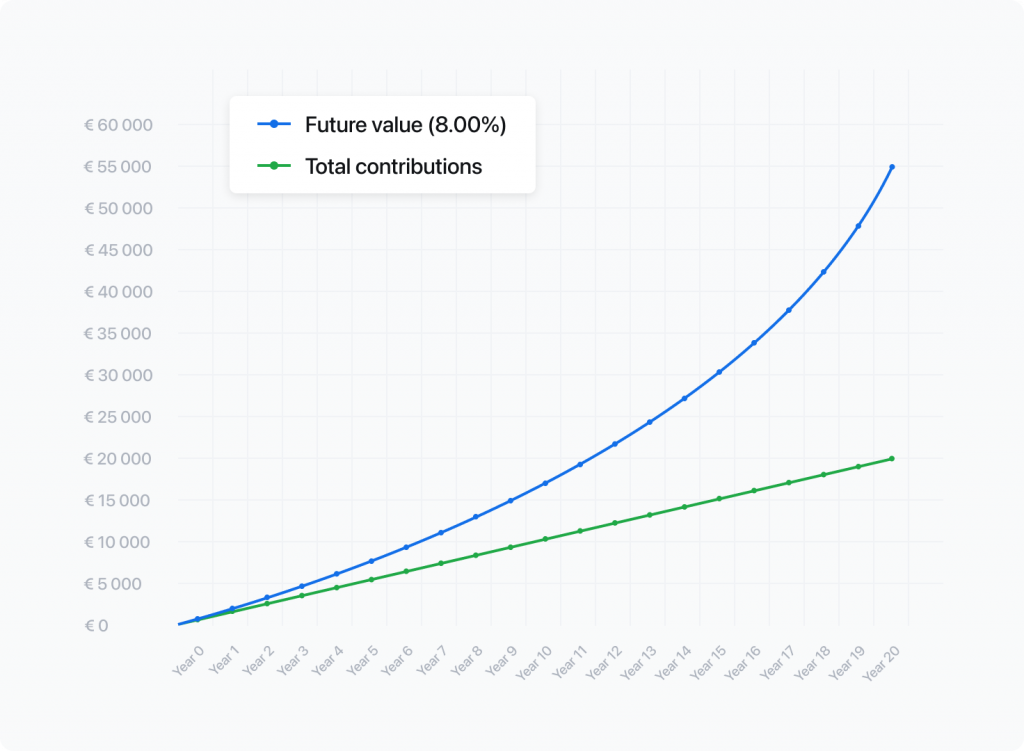

For hundreds of years, people have used investing as a means to build wealth. The reason long-term investing is so effective is because of compound growth. Investment returns compound (grow bigger and bigger) each time they are reinvested, helping you reach your financial goals faster. For example, if you invest €100 a month over the next 20 years at an 8% interest rate, each year, your funds grow at a faster pace. The idea is that by the end of the investment period, you have significantly more money than if you’d added the same amount to a savings account.

For many, this provides the financial means to pay for education, homeownership, cars, travel, retirement; the list goes on! So people often look to investing because it can provide them with opportunities.

What do people usually invest in?

When you own something of value that can be converted to money, it’s described as an asset. Assets can be liquid, meaning they can be quickly converted to money, or illiquid, where it’s more timely and complex to turn them into money. In the investment market, assets are categorized into asset classes, which are groups of assets with similar characteristics. Some examples of popular asset classes are:

Where to start if you’d like to begin investing

Ways of investing come in all shapes and sizes, and how investors choose to invest usually comes down to their prior experience and financial objectives. Although the investment landscape may seem vast, there are options to suit everyone.

A great way to get started is to set investment goals. Once you have some clarity around your goals and budget, you can begin to research which assets or asset classes suit your financial objectives and your risk appetite.

Investment platforms that offer simple, automated investing strategies can be an easy place to start. These strategies are built using expert analysis and data, reducing the need for prior expertise or timely in-depth research. Investments in Exchange Traded Funds (big investment portfolios that investors can buy shares in) are also relatively straightforward. They’re managed by investment firms and require no work from the investor’s perspective. Or, if you’d like to have more control, you can research and manually make individual investment decisions through investment platforms or brokers.

Some investors only have one asset, such as a real estate investment, while others own many different assets, forming what’s known as an investment portfolio. When creating a portfolio, it’s important not to put all of your eggs in one basket. It can be beneficial to invest smaller amounts of money across multiple assets, so your lower-risk investments balance out your higher-risk investments – an investment strategy known as diversification. Doing this can often increase the chances that you’ll achieve the returns you expected.

In terms of money, many platforms only require small amounts to get started; for example, on Mintos, you can begin investing with €50. When you invest responsibly, even a little money can go a long way and bring you closer to achieving financial freedom.

If you’d like to check out the options on Mintos, see Investing with Mintos.

Mintos Activity: June 2023

Total investments saw €88 million worth of Notes funded and interest earned by investors in June was €3.9 million.

The average interest rate for June stood at 12.8%, translating to an annualized average net return of 9.8% (YTD 4.7%). The cumulative interest earned by investors on Mintos has now reached €238 million and the total assets under administration are now €583 million.

Get started

You’ll earn €5 for every new customer who verifies their account and a 1% bonus of the average investment in the first 90 days.

- Log into your TargetCircle account

- Create promotional material

- Create a tracking link for the following page: https://www.mintos.com/en/mintos-affiliate-program